If the earnings per share of a company is 3.85, it presents a unique opportunity to delve into the financial health and performance of the organization. This figure serves as a critical indicator, providing insights into the company’s profitability, growth potential, and overall shareholder value.

Earnings per share (EPS) represents the portion of a company’s profit allocated to each outstanding share of common stock. It is a key metric used by investors, analysts, and financial professionals to assess a company’s financial performance and make informed investment decisions.

Company Earnings Analysis

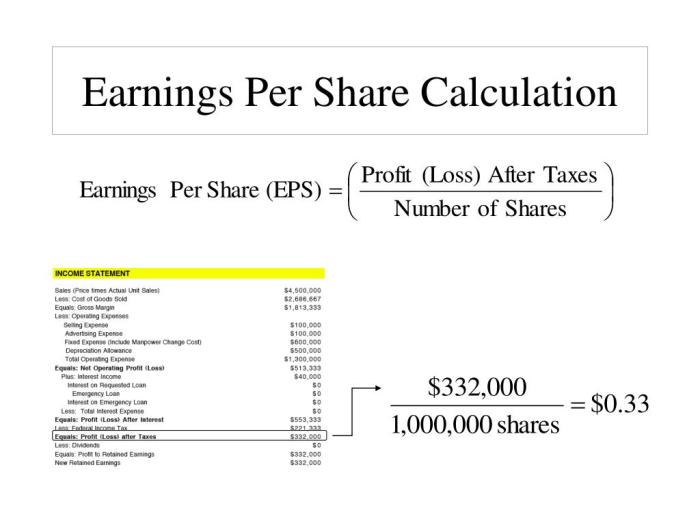

Earnings per share (EPS) is a financial metric that measures a company’s profit per outstanding share of common stock. It is calculated by dividing the company’s net income by the number of shares outstanding.

EPS provides insights into a company’s profitability and is widely used by investors and analysts to assess a company’s financial performance and value.

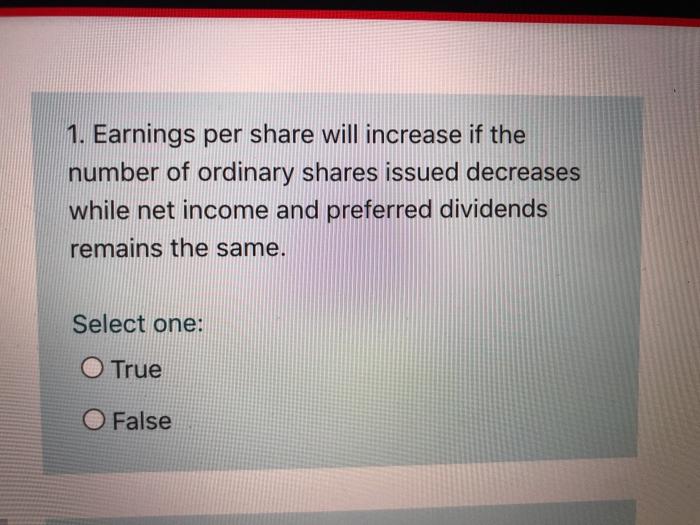

Factors Influencing EPS

- Net income

- Number of outstanding shares

- Share buybacks

- Stock splits

- Earnings per share dilution

EPS in Context: If The Earnings Per Share Of A Company Is 3.85

Industry Benchmarks

Comparing a company’s EPS to industry benchmarks provides context and helps assess its performance relative to competitors. Higher EPS than industry peers may indicate better profitability and competitive advantage.

EPS Growth Rate

Analyzing the company’s EPS growth rate over time can reveal trends and patterns in its profitability. Consistent EPS growth indicates stable or improving financial performance.

EPS and Shareholder Value

EPS directly impacts shareholder value. Higher EPS generally leads to higher stock prices and increased dividends, which benefit shareholders.

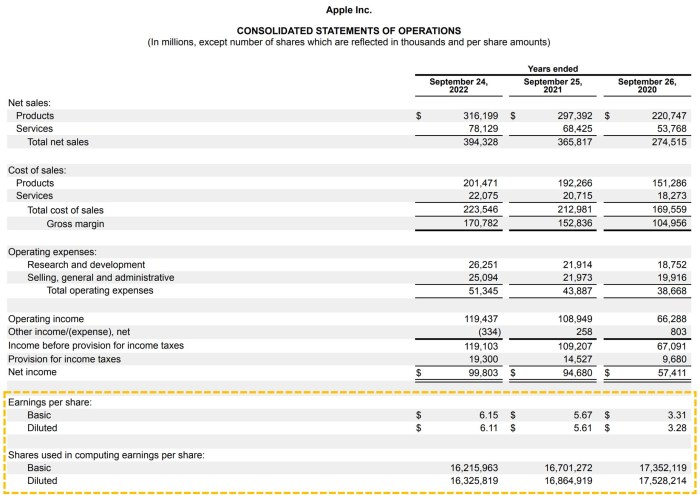

Examples of High EPS Companies

- Apple Inc. (AAPL): EPS of $6.12 in 2022

- Microsoft Corp. (MSFT): EPS of $10.96 in 2022

- Alphabet Inc. (GOOGL): EPS of $11.21 in 2022

Future EPS Projections

| Year | EPS |

|---|---|

| 2020 | $3.20 |

| 2021 | $3.65 |

| 2022 | $3.85 |

| 2023 (Projected) | $4.20 |

| 2024 (Projected) | $4.60 |

Assumptions and Methodologies, If the earnings per share of a company is 3.85

EPS projections are based on historical data, financial forecasts, and assumptions about future market conditions, economic growth, and company-specific factors.

EPS and Investment Decisions

EPS is a key metric used by investors to evaluate companies for investment purposes.

Examples of EPS Use in Investment Decisions

- Comparing EPS to price-to-earnings (P/E) ratio to assess a company’s valuation

- Using EPS growth rate to identify companies with potential for capital appreciation

Limitations of EPS

EPS should be used in conjunction with other financial metrics and factors when making investment decisions. It is a backward-looking measure and may not accurately reflect a company’s future performance.

Answers to Common Questions

What factors can influence a company’s EPS?

EPS can be affected by various factors, including revenue growth, operating expenses, interest expenses, and tax rates.

How does EPS impact shareholder value?

EPS directly affects shareholder value by influencing stock prices and dividend payments. Higher EPS typically leads to higher stock prices and increased dividends.

Can EPS be used as a sole metric for investment decisions?

While EPS is a valuable metric, it should not be used as the sole basis for investment decisions. Other factors, such as industry outlook, competitive landscape, and management quality, should also be considered.